Cryptocurrencies open up a new asset class for investors. Unlike stocks or bonds, you can't (yet) buy cryptocurrencies directly from most banks or traditional securities brokers. Instead, a crypto ecosystem has emerged that focuses exclusively on trading cryptocurrencies. The traditional financial system also offers ways to access crypto investments, but they have a significant cost disadvantage. In this article, we will introduce you to both ways and explain the pros and cons of each.

The workaround: How to invest in cryptocurrencies through the traditional financial system

Suppose you don't want to deal with crypto exchanges, wallets, and crypto apps. In that case, you can also access crypto assets through familiar investment channels: There are certificates that securitize either individual cryptocurrencies such as Bitcoin or Ethereum or a basket of multiple cryptocurrencies. Some Alternative Investment Funds (AIFs) also specialize in cryptocurrency trading. Passive funds track an index of cryptocurrencies, and actively managed funds trade cryptocurrencies aiming to outperform the markets (whether or not they succeed with that mission is another story).

The advantage of these instruments is that you can add them to your portfolio through established channels. They usually come with an ISIN, and you can buy and sell them via traditional exchanges. The downside is that the asset manager and custodian charge fees. Also, beware that with certificates or funds, you usually don't hold the asset directly but only have a participation right in an asset pool. In a way, these instruments contradict the basic idea of financial sovereignty that we promote here in the CryptStudio because you are still dependent on financial intermediaries that reduce your return.

People realizing that they don't need to pay ETF 1% fees or Grayscale 2% fees to own #Bitcoin.

— Mira Christanto (@asiahodl) April 1, 2021

Be your own bank pic.twitter.com/nkD081DqTG

More and more investors decide to buy their cryptos by themselves

You could also buy stocks of digital assets service providers, such as a crypto exchange. However, you won't get direct exposure to the crypto asset class this way because you are not directly investing in cryptocurrencies. While crypto exchanges benefit from the growth of the crypto market, their stocks have similar characteristics to other stocks and are highly correlated to the overall stock market. You can indirectly benefit from the crypto market through such investments, but you are not investing in the cryptocurrency asset class and its particular value drivers.

The real deal: How to invest in cryptocurrencies in the crypto ecosystem

The second way (and in our opinion the better way) is to familiarize yourself with the crypto ecosystem. No worries, it's not that difficult! Just like in the traditional financial industry, you can acquire cryptocurrencies either in the primary market or trade in secondary markets.

In the primary market, investors can acquire newly issued coins or tokens. Utility Tokens are issued in so-called Initial Coin Offerings (ICOs) and Security Tokens in Security Token Offerings (STOs). In most cases, you can purchase these tokens directly from the issuer via its website. An exception are so-called Initial Exchange Offerings (IEOs), whereby the issuer issues new tokens via a crypto exchange. Similar to participation in Initial Public Offerings (IPOs) in the traditional financial system, token offerings usually involve high risks. The tokens are new and have not yet proven themselves in the market. While this also offers good return opportunities, it is difficult for most investors to realistically assess the risks due to a lack of transparency.

For most investors, the best way to buy cryptocurrencies is through secondary trading. In secondary markets, there is both over-the-counter (OTC) trading and exchange-based trading. OTC transactions are usually only relevant for large sums or exotic coins that are not listed on any exchange. For the majority of investors, especially beginners, it's best to buy cryptos through established crypto exchanges. Here you can trade most coins easily and typically at low fees, use proven and professional infrastructure, and you operate in a regulated environment (depending on which exchange you choose). You still bear the investment risks, of course, but you can reduce the risk of falling victim to fraud attempts or losing your money due to poor IT security.

How to invest in cryptocurrencies? Step-by-step guide

So let’s get practical: How to invest in Bitcoin? How to invest in Ethereum? Let’s look at six easy steps that will get you ready to invest in cryptocurrencies.

Step 1: Choose an exchange

Choosing a crypto exchange comes down to four questions:

1. What functionalities does the exchange offer, and what are the trading fees?

2. What deposit and withdrawal methods does the exchange offer for fiat currencies, and at what fees?

3. How secure is the exchange in terms of IT security, and are users' assets insured?

4. Does the user interface meet your needs?

Take a look at our exchange reviews, where we have analyzed the leading providers based on these four categories. We also show you which exchanges are suitable for beginners and advanced investors.

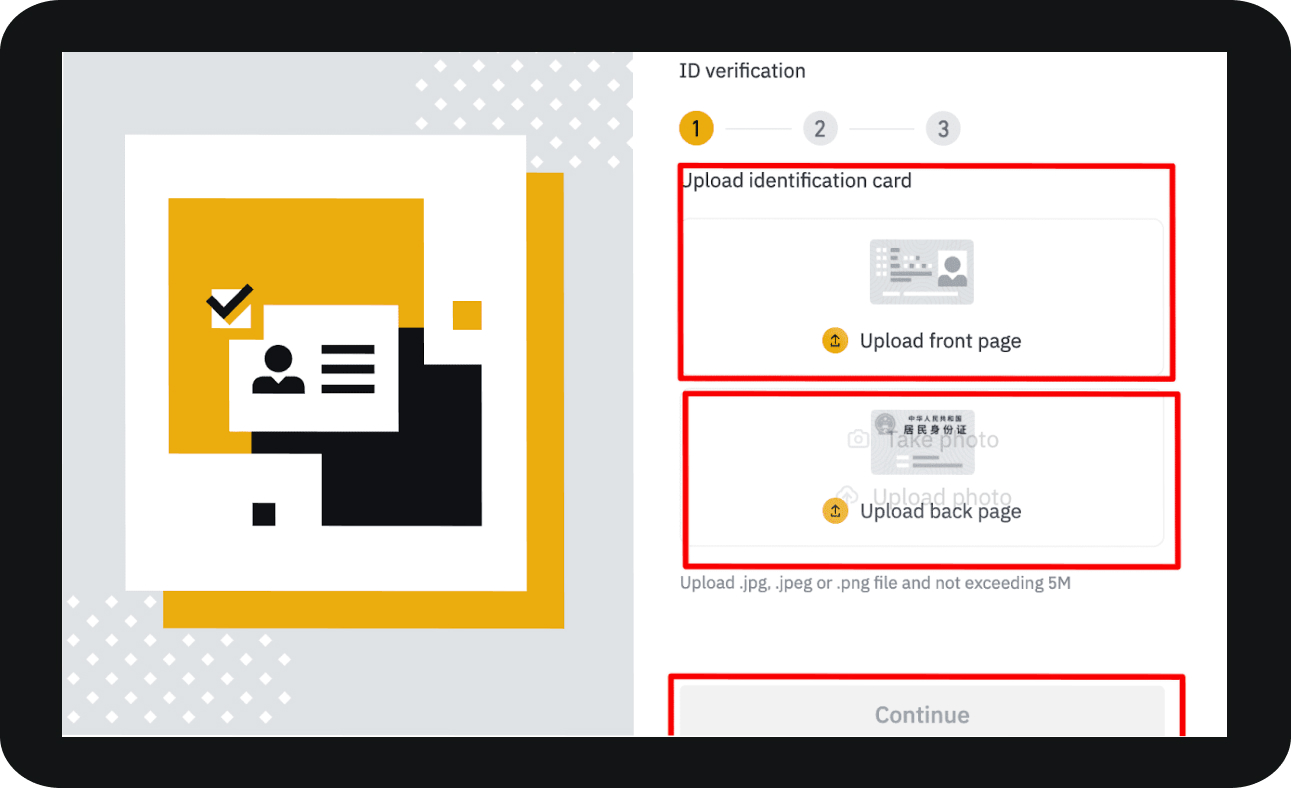

Step 2: KYC

Once you have decided on an exchange, you need to open an account there. Since crypto exchanges are subject to regulations in most countries, you usually have to prove your identity before you can start trading. This is called KYC ("Know Your Customer"), and you usually have to provide your passport, ID card, or driver's license. KYC is required by law and is primarily used to combat money laundering. At many exchanges you can trade up to a certain limit without KYC legitimization, but as soon as you want to trade larger amounts or deposit or withdraw fiat currencies, you have to go through KYC. Also, beware that you may experience long waiting times depending on the exchange if there is high demand for new user accounts. So, if you open an account in a bull market, you should allow at least a couple of days, maybe even several weeks.

KYC-process of crypto exchange Binance

KYC-process of crypto exchange Binance

Step 3: Fund your account

Once you've opened your account, you'll first need to deposit money to buy cryptocurrencies. The interface between the traditional banking world, the world of fiat currencies, and the crypto ecosystem is called the "fiat gateway." Exchanges offer you various options for the fiat gateway, usually at least bank transfers and debit and credit card payments. With many exchanges, you can also use PayPal, Western Union, or other payment providers. Alternatively, you can also fund your account with cryptocurrencies if you already have some in another wallet.

Step 4: Buying cryptocurrencies

Once you've funded your account, you can buy cryptocurrencies through the exchange. Some exchanges, such as Coinbase or Binance, offer a so-called "Lite Trading Mode" for this purpose, where you just have to click on "buy" or "sell." It couldn't be any easier!

Buy and sell cryptocurrencies on Coinbase

Buy and sell cryptocurrencies on Coinbase

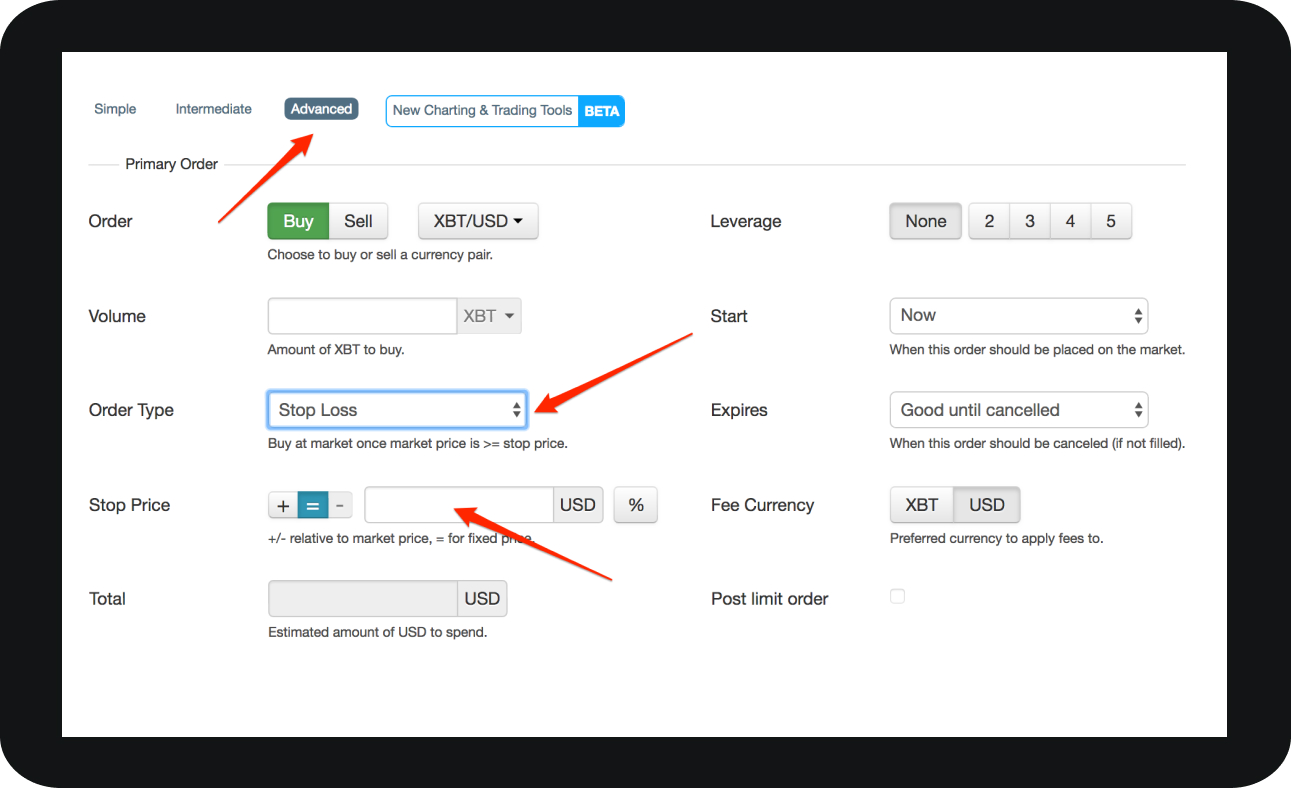

At exchanges that offer an advanced trading mode, you can work with more complex buy and sell orders, similar to traditional securities trading.

Kraken advanced order screen

Kraken advanced order screen

Step 5: Selling cryptocurrencies

If you want to sell your cryptocurrencies, some crypto exchanges again allow you to use the Lite Trading Mode or the advanced order screen. Beware that the exchange will again charge fees when you are selling. You can sell your cryptocurrencies either for another cryptocurrency or for a fiat currency.

Step 6: Withdraw money

If you want to withdraw money, you can sell your cryptocurrencies for fiat currencies and withdraw your money via the withdrawal methods supported by the exchange. Bank transfers and debit and credit card payments are the most common payment methods. You should also note that both deposits and withdrawals usually incur fees, either from the exchange or the payment provider, or both. Most exchanges have a withdrawal limit.

.png)